There is also a separate tax relief for lifestyle expenses for sport activities. Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019.

The Complete Income Tax Guide 2022

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2020.

. The above are also available to a. - As Heard on. To promote domestic tourism a special income tax relief of up to RM1000 will be provided to individuals for.

Limited 1500 for only one mother. Medical expenses for parents. For YA 2021 extended until YA.

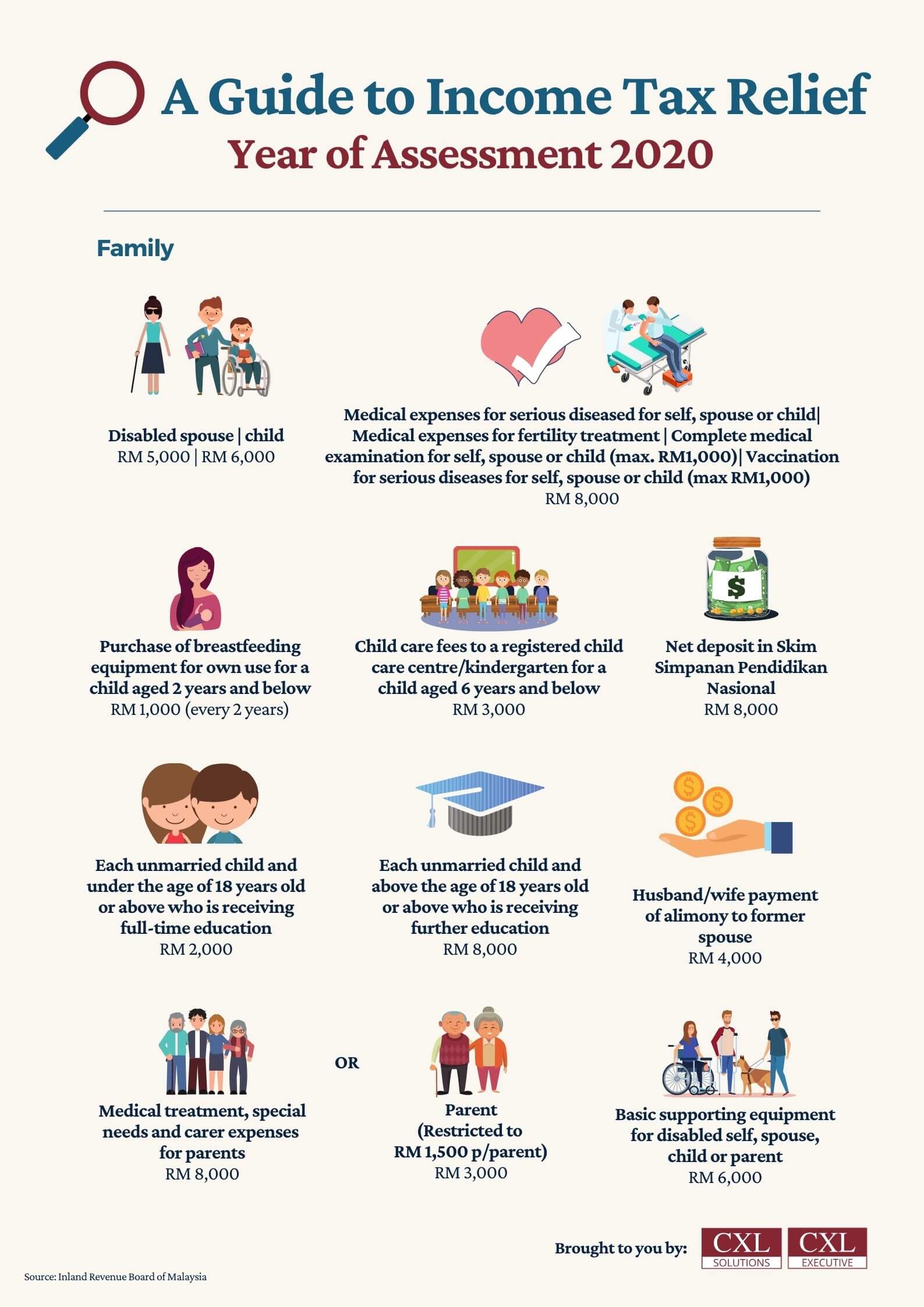

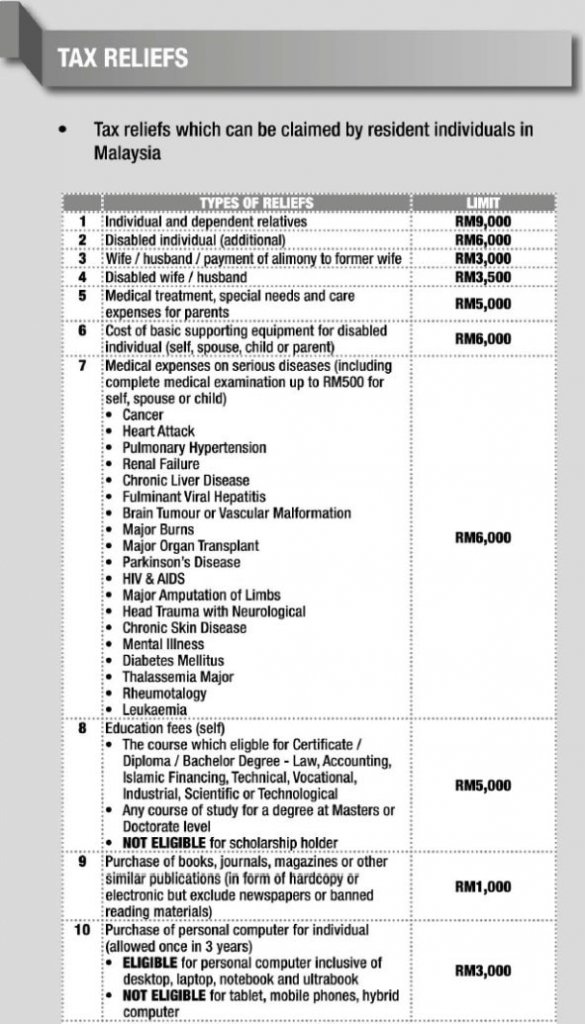

Tax Relief for Child i Ordinary Child Relief. These Are The Personal Tax Reliefs You Can Claim In Malaysia. This booklet also incorporates in coloured italics the 2023.

IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. Heres How A Tax Rebate. Disabled Child Aged 18 Above Pursuing Higher Education.

For public servants under the pension scheme combined relief up to RM7000 is given on Takaful contributions or payment for life insurance premium. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. Thanks to the Economic Stimulus Package 2020 announced by Interim Prime Minister Tun Dr Mahathir Mohamad yesterday Malaysian can now to claim up to RM1000.

Find Out Which Taxable Income Band You Are In. Receiving full time education diploma and. Amount RM Self and dependent.

Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. The education tax relief for your children falls under Parenthood which we will cover below. In Budget 2020 an additional lifestyle tax relief for the purchase of personal computer smartphone or.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Child aged below 18. Malaysias Minister of Finance MOF presented the 2021 Budget proposals on 6 November 2020 announcing a slight reduction in the individual income tax rate by 1 percent.

Tax Relief Year 2020. Its tax season again for Malaysians earning over. Personal reliefs The following personal reliefs can also be deducted in arriving at chargeable income of the resident individual for YA 2021.

Tax rebate for self. Web In late February this year it was announced under the 2020 Economic Stimulus Package that Malaysians who travel locally can enjoy special personal income tax relief up to. The Tax tables below include the tax.

Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. Self Parents and Spouses Automatic Individual Relief Claim allowed.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. Child aged above 18 with following condition. SPECIAL INCOME TAX RELIEF ON DOMESTIC TRAVEL 17.

This would enable you to drop down a tax bracket lower. Individual and dependent relatives Granted automatically to an individual for. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

Penjana Tax Relief And Stimulus For Malaysia Budget 2021 Financio

Personal Tax Relief 2021 L Co Accountants

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia S Budget 2020 Rodl Partner

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

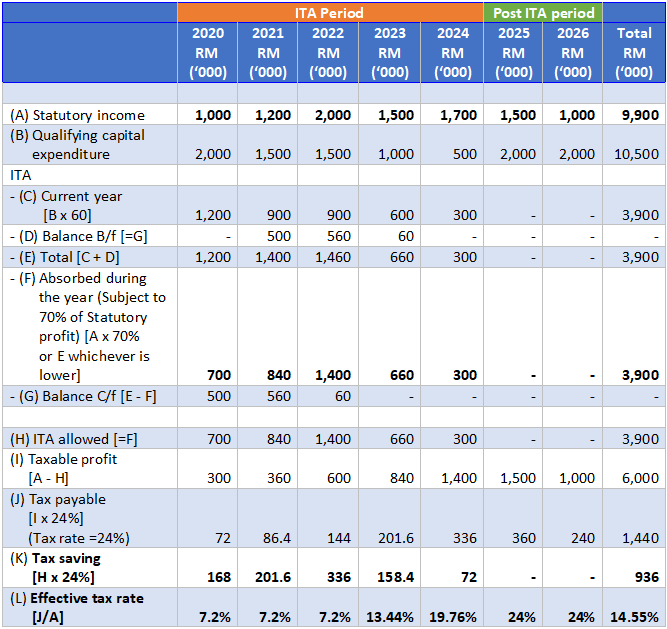

What Is The Difference Between The Statutory And Effective Tax Rate

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

New Additions Income Tax Relief For The Year Of Assessment 2020 Cxl

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Ctos Lhdn E Filing Guide For Clueless Employees

Guide To Using Lhdn E Filing To File Your Income Tax

Tax Relief Malaysia Everything You Can Claim In 2021 For Ya 2020